Most of us know Agile as an effective methodology that is used in project management. But now, the advent of Agile into the banking sector where its related practices like customer service, wealth management, and marketing activities have been taking organizations to remarkable heights. Although it's still new to the banking sector, it is nowhere less to a powerful methodology that simplifies certain banking functions. The application of agile methodology into the banking sector can address challenges that are beyond just IT-related.

The transition of the existing banking world into digitally stable financial institutions is yet to be a fully achieved goal. There is an emergence in making banking institutions and their business models include cutting-edge technologies. Reforming the business models and striving towards digital transformation can improve the banking sector to deliver hassle-free solutions to their customers. Online banking is not about creating an e-account with fewer facilities online. It is about adopting digital technologies that are user-friendly digitally. The impact of a strong online presence is a big wheel that drives an organization on an appropriate path. A refocus has to be made on the digital development business models to flourish well as strong financial institutions. To become one, Agile should be an integral part of their regular functions.

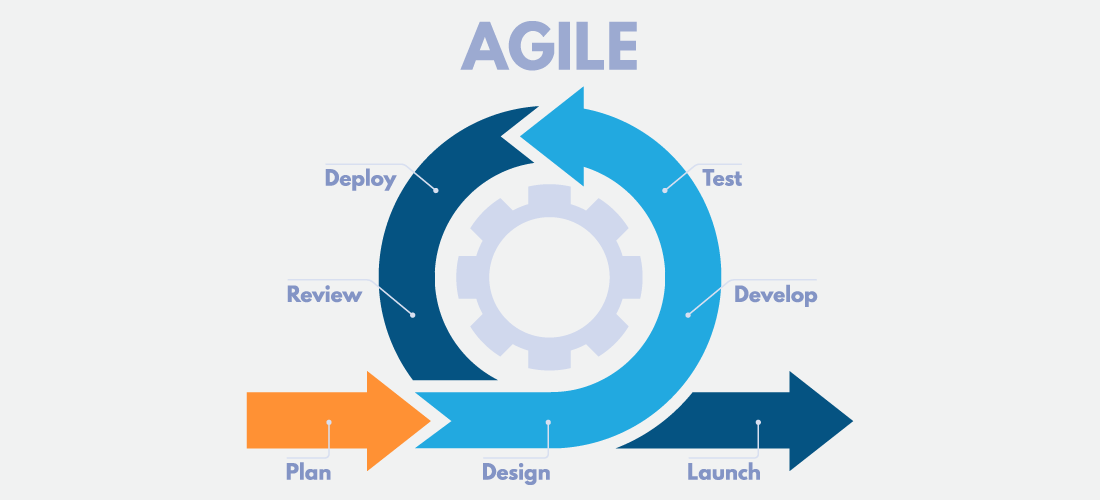

Agile is a data-driven approach where developing and examining a product at desired phase instead of waiting for complete project delivery. Troubleshooting is done quicker and at an early stage without waiting for the complete process to finish. The game of test and learn can be carried out throughout the process. A report by McKinsey & Company says that Agile has a huge capacity to multiply the product development speed by five times. Digital transformation can be accelerated with the application of Agile.

Considering a few examples, Vantiv (currently unified as Worldpay) which is a popular US payment process has adopted agile techniques and states that it processes more than 11 billion transactions and 400 USD billion every annum in sales. Diverse startups and FinTechs have already seen the ripened fruits with the help of adapting themselves to agile techniques. The application of agile methodology into the banking sector can address challenges that are beyond just IT-related.

We need to understand that agile is not alone for software product development. Agile enables the organization to deliver its business objectives more efficiently and effectively.

Agile banking in current banking sector:

The waterfall model (an incremental approach where the project development life cycle is divided into sprints) in banking institutions concerning Agile has been working immensely great. Although Agile seems to be new to the banking community, it always has a larger scope to help banks to access their data without much complexity. The banking institutions must utilize the opportunity of using agile to fasten and transcend.

One such greatest example is BBVA Compass which is a financial institution that has completely dedicated itself to agile principles and processes. The most exciting part to learn is, the BBVA Compass develops almost 60% of its software using agile, and also it is known for its development time cutting from two years to six months and less down the line by using the famous waterfall model.

Top 3 reasons to know about Agile within the Banking framework:

- Agile just doesn't give results that are related to product management. It helps in understanding the customers' needs and fulfilling them in real life. Working for customer experience by closing every touchpoint is prioritized above all. And that makes all the difference.

- Agile in banking helps banking institutions choose what’s necessary for customers in the first place. And then thinks of itself. Digital transformation can be brought about to provide the best customer service with an agile manifesto.

- Agile is known for its flexibility. The data of the banking institutions have to be controlled by using powerful data analytics. Agile facilitates the responsive applications that use such data. Customer-focussed products can be delivered through this process within an optimum time.

Therefore, Agile can be used in banking sectors to fasten up their development process. Crucially, customer-friendliness can be achieved through improved digital banking platforms.

If you also wish to pursue a career in Agile, here is a jump to make! Our exclusive course on Agile can help you become a proficient scrum professional. Acquire Agile skills to improve your project management qualities. We’ve got the industry’s best mentors to make you understand in the best way. Become an Agile scrum master in 16 hours with job assistance. Make a move today and enter into a career in digital transformation.

©️ 2024 Edify Educational Services Pvt. Ltd. All rights reserved. | The logos used are the trademarks of respective universities and institutions.